In this article, you will get a step-by-step guide to the Mutual Of Omaha Medicare Supplement Login (provider). So, follow this guide to get into your account the easiest way possible and check your Claims Information, Medicare Supplement Eligibility, and Benefits.

Medicare Supplement plans are a great way to save money. These plans are flexible and can be used as a regular monthly bill or add-on to your existing plan while also saving you money on your monthly premium costs. If you are an Omaha Medicare Supplement provider following steps will guide you on how t login into your account:

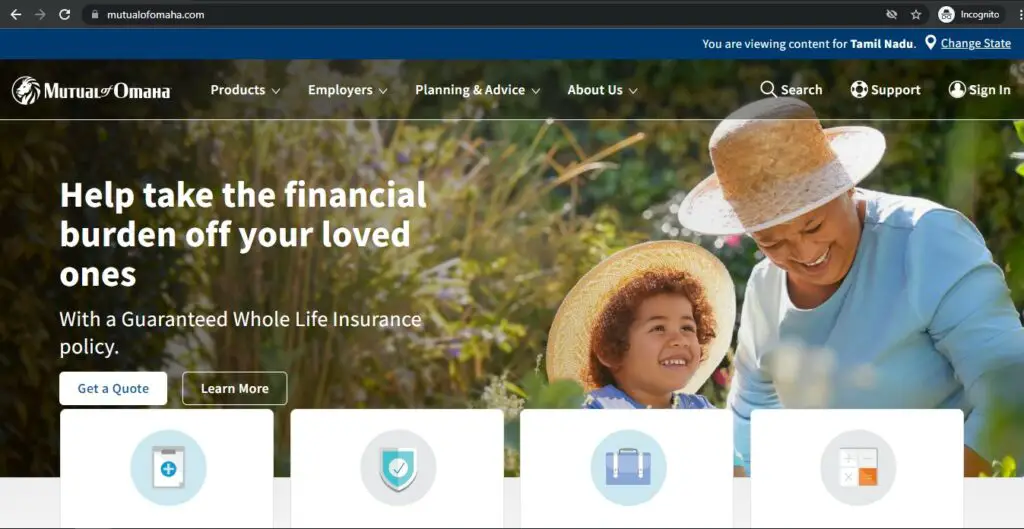

Visit the website

Visit the official website of Omaha Medicare at https://www.mutualofomaha.com/. Then, click on the “sign-in” button on the top-right corner of the screen.

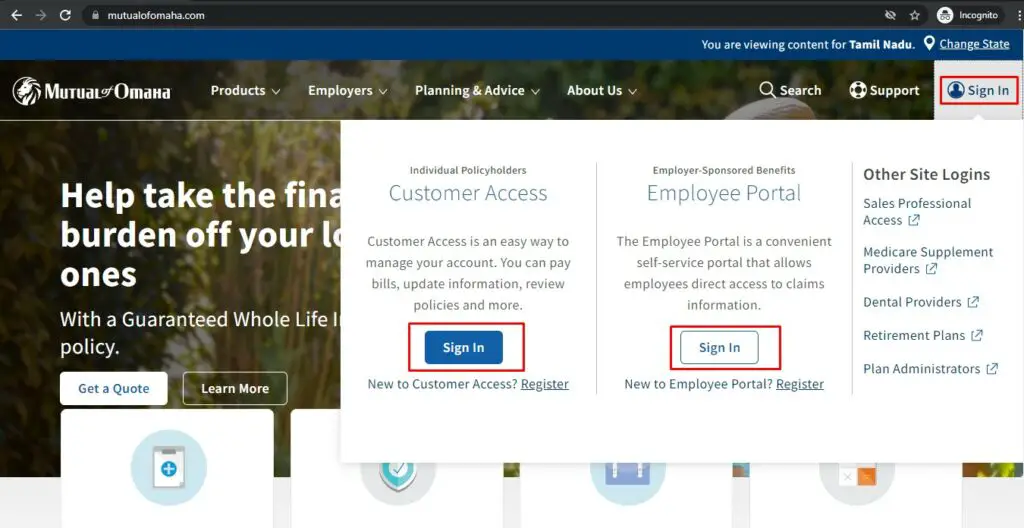

Chose the login portal

Clicking on “sign-in” will open 3 login portals. Click on the “Medicare Supplement Providers” under the third login portal named “Other Site Logins.”

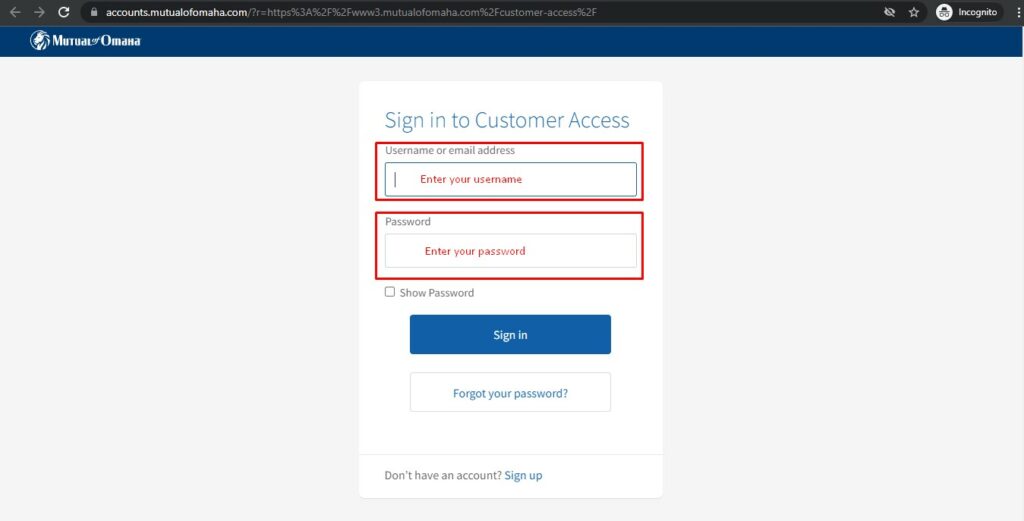

Enter Details

Next, click on login. It will direct you to a new tab where you must enter your “Tax Identification Number (TIN)” and then accept the terms and conditions by ticking the box and signing in. If your TIN is correct, you’ll be opened up to your account at Medicare Supplement Providers with ease!

Here is the video guide

What is Medicare Part and plans?

Medicare Part A, B, C, and D are the three parts of the Medicare program. The government handles parts A and B. Medicare Part C is also known as Medicare Advantage. The purpose of Part C is to cover a wide range of insurance coverage. Medicare Part D is coverage of prescription drugs provided through hospitals.

The government introduced a new program that allows people to supplement their healthcare expenses by paying part of them into a retirement account to access more money towards future medical needs. The program is called “Medicare Supplement Insurance” (MSI). Several Medicare supplement insurance plans, i.e., Plan A through Plan N.

MSI offers many additional benefits, such as coverage for prescription drugs and dental care and life insurance or annuities for those who don’t have any other options. It’s also worth noting that most healthcare professionals have strongly endorsed MSI; doctors, nurses, pharmacists, and dentists support the program entirely.

About Aetna Medicare Supplement Insurance

With Medicare Supplement insurance, we are cutting hard to help your wallet. We believe every individual should be able to make better health decisions for themselves and their family, which is why we’re going to sell you a product that fits your needs and budgets so you can have peace of mind with 100% certainty.”

Medicare Supplement insurance is a new way for seniors to take care of themselves at a fraction of the cost. It covers your basic needs such as food, utilities, and health expenses. In addition, this card protects you from emergencies and pays for your medical expenses if you become sick.

The Medicare Supplement Insurance is an excellent alternative to Medicare Part A and B plans. Here are some of the advantages: Medicare Supplement Insurance scripts help cut costs that Plan A& B might cause. In addition, with Medicare Supplement Insurance, you can have a very high level of coverage and still eliminate some of the costs. These include costs like coinsurance, copays, and deductibles.